Quarterly Commentary 1Q’25

A Rebalancing World

As we craft this communication in early April, the first Quarter of 2025 - which ended 3/31/25 - somehow seems a world away. The tariffs Trump announced on April 2 were world-shifting, making this year’s earlier events seem relatively inconsequential. Yet the world order was already shifting during those early months of 2025, in ways economic and not.

After the first few relatively stable weeks of January, the narrative and the markets pivoted with jarring speed. Early optimism quickly faded when, in late January, Chinese AI start-up DeepSeek unveiled technology that cast doubt on the long-presumed U.S. dominance in artificial intelligence. That was followed by a series of policy shifts from the incoming Trump administration: announced layoffs of government workers, elimination of entire government agencies, and early signs of a big reordering of global alliances in political and economic ways. By March, initial policy uncertainty had transformed into broad economic anxiety, unsettling markets from Wall Street to Main Street. This fear was measurable: consumer sentiment, as surveyed by the University of Michigan*, plunged to levels last seen during the turbulent days of 2020, validating investor unease . The message from markets was clear—this was a bruising quarter.

In response to rising economic uncertainty stemming from shifting U.S. policies, global policymakers acted swiftly and decisively. Japan, finally stepping out from deflation's shadow, aligned its monetary and fiscal policies with unprecedented coordination. China redirected its stimulus from infrastructure projects to consumer-focused initiatives, marking a significant shift in economic strategy. In Europe, after prolonged austerity, governments expanded fiscal spending aggressively.

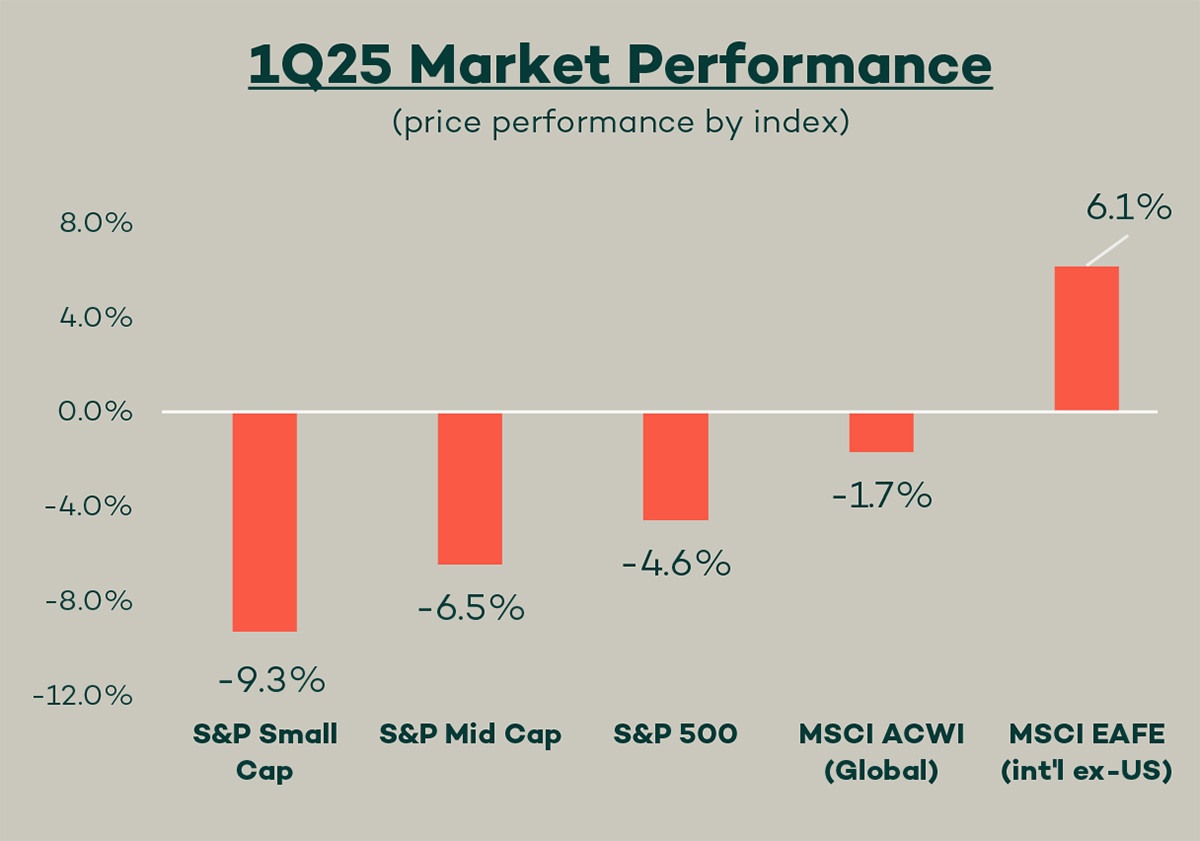

Market reaction was also swift. As global policymakers acted in concert, international markets pulled ahead of U.S. benchmarks. The MSCI EAFE index—which includes Europe and Japan—rose 6.1% for the quarter, outperforming the S&P 500 by nearly 11 percentage points, as the U.S. benchmark declined 4.6% (see chart left). Nowhere was the divergence more acute than in U.S. small-cap stocks, which sank over 9%, hampered by the triple burden of higher borrowing costs, sticky inflation, and eroding economic sentiment. In the face of this volatility, investors sought safety, lifting the U.S. Aggregate Bond Index by nearly 3% for the quarter.

Figure 8 faced specific headwinds in Q1 from our exposure to energy efficiency leaders (First Solar, Trane Technologies) and select AI beneficiaries (Alphabet, NVent). These challenges were partially offset by stronger performance from globally diversified companies such as Deere, Sony Group, and NXP Semiconductors, which benefited from the international policy momentum described earlier.

As we enter Q2, investors are grappling with a deeply conflicted landscape. U.S. GDP growth is projected to slow sharply to 1.0-1.5%, down from 2.8% a year ago. The “Magnificent 7” tech leaders fell roughly 15% through March 31 and have continued to decline in early April amid tariff news. Meanwhile, erratic trade policy is injecting additional uncertainty into an already fragile market backdrop.

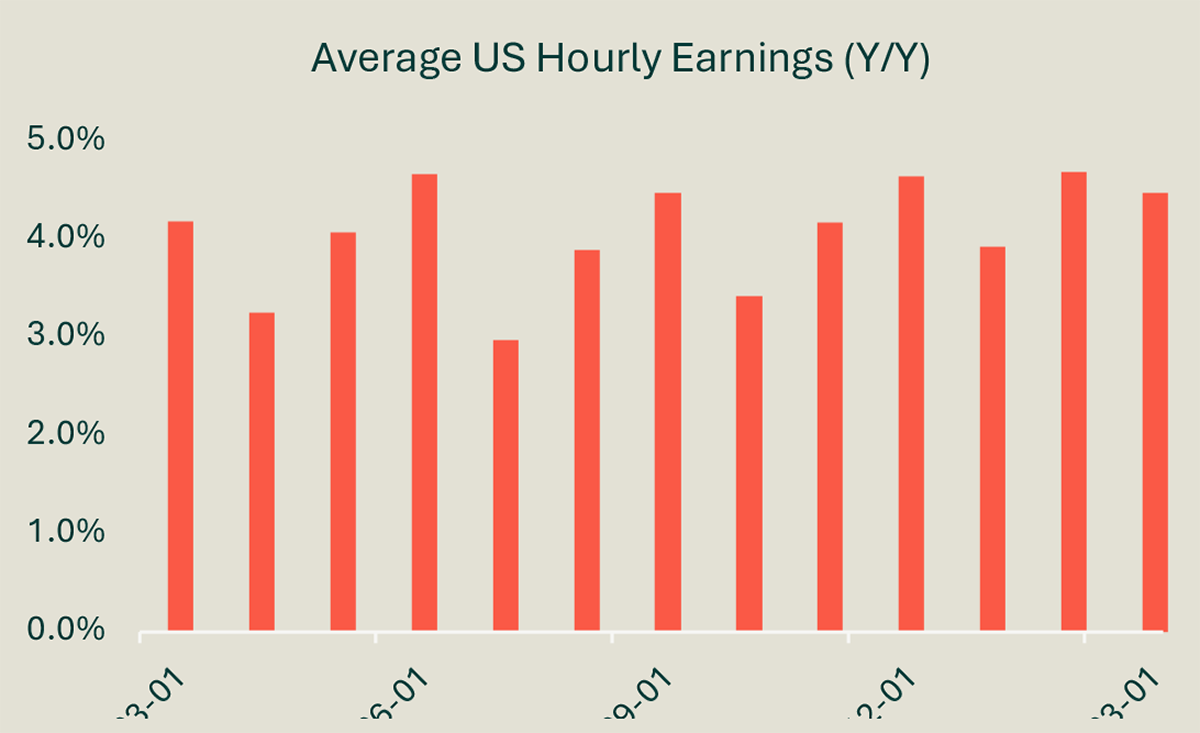

And yet, the current economic data continues to tell a different story. Unemployment remains steady at 4.2%, wages are growing +4% y/y, and corporate earnings were up a healthy 11% in 2024. Sentiment may suggest a crisis, but the hard data—at least for now—signal an ongoing adjustment, not a collapse. In an environment defined by contradiction and rapid change, our approach remains clear: be disciplined, not reactive.

Rebalancing Portfolios

As headlines intensified throughout the quarter, we remained anchored on what we know works best in a time of great uncertainty: diversifying across sectors and geographies to manage risk, sticking with quality companies that have robust balance sheets, and investing where we have confidence that corporate leadership will adapt to shifting trade conditions while maintaining their core principles. In Q1, we continued to reduce exposure to the largest technology stocks (Microsoft, Alphabet, and Taiwan Semiconductor) on concerns about extended valuations, and redeployed capital into businesses addressing durable structural needs, notably:

Aptiv: Added a new position in this Tier-1 automotive supplier with expertise in high-voltage electrical systems and vehicle safety, acquired opportunistically amid the cyclical downturn in EV valuations.

Kerry Group: Increased our position in this global leader in taste and nutrition, attracted by its extensive geographic reach, robust growth in high-demand segments, strong sustainability commitments, and steadily improving profitability.

Nextracker: Expanded our stake in this leading solar-tracking solutions provider, capitalizing on accelerating global demand despite recent policy turbulence.

AvalonBay: Added a new position in this multi-family REIT chosen for its operational sustainability strategy and attractive positioning in affordable housing within supply-constrained coastal markets.

The Sustainability Shift: Don’t Mistake Silence for Surrender

The recent political climate has not only complicated near-term economic prospects but also influenced how companies publicly approach their sustainability initiatives. With new pressure from the Trump White House to brand terms like “DEI” and “climate” as taboo, many corporations previously vocal about climate commitments have begun deliberately understating these efforts—a practice increasingly referred to as "greenhushing." The shift is measurable: environmental mentions on S&P 500 earnings calls have dropped 76% over the past three years.**

But a quieter tone doesn’t equal a strategic retreat. In many cases, sustainability messaging is being reframed—emphasizing job creation, energy independence, and domestic manufacturing.

The regulatory landscape has also shifted. In March, the Environmental Protection Agency launched what it called the most significant rollback of climate-related rules in history – repealing or weakening 30+ regulations tied to emissions, water, and air quality. At the same time, the European Parliament delayed implementation of sustainability reporting requirements, particularly for small firms. The result: reduced transparency, inconsistent disclosures, and new challenges in benchmarking progress across companies and timeframes.

Despite these headlines, which might suggest a retreat from sustainability, the underlying data again tells a very different story. According to the International Energy Agency (IEA)***, global clean energy investment reached ~$2 trillion in 2024, nearly double the levels for fossil fuels (see right chart).

That momentum has carried into 2025. Renewables are expected to account for 93% of new U.S. power capacity this year. Despite softened public communications, corporate climate commitments remain resilient: 84% of companies with climate targets are maintaining or accelerating them, according to PwC****. A survey of 4,700 CEOs found that one-third are already seeing revenue growth from climate-related investments. Meanwhile, 92% of CFOs surveyed by Kearney plan to increase sustainability spending this year.*****

The contrast is unmistakable: while the narrative suggests retreat, the data shows momentum. For investors willing to look beyond the headlines, the sustainable transition continues to offer real, long-term opportunity.

* The University of Michigan Survey measures consumer attitudes toward personal finances, business conditions & economic expectations, providing a key indicator of future spending & saving.** Bloomberg “Climate Chatter Declines”, 3/26/25*** IEA (2024 Report): Global investment in clean energy and fossil fuels, 2015-2024**** PWC’s Second Annual State of Decarbonization Report (2025)***** Kearney: Staying the course – chief financial officers and the green transition (2-17-25)Sources for 1Q25 Market Performances: Bloomberg, Black Diamond. Macro-economic data and estimate sources: Bloomberg/Wall Street Consensus, St. Louis Federal Reserve (FRED)You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. This material is intended for educational purposes only. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost.