Quarterly Commentary 2Q’25

62 Volatile Sessions

So far in 2025, U.S. markets have been driven by a collision between troubling news on the one hand – tariff announcements, policy whiplash, and geopolitical friction – and downright solid economic data on the other. It feels a bit schizophrenic, as investor sentiment has ricocheted from panic to uncertainty and then to cautious optimism. Yet throughout this past quarter, US job growth was steady, corporate earnings remained strong, and consumer spending held firm. This gap between sentiment and economic metrics defined the 2nd quarter of 2025.

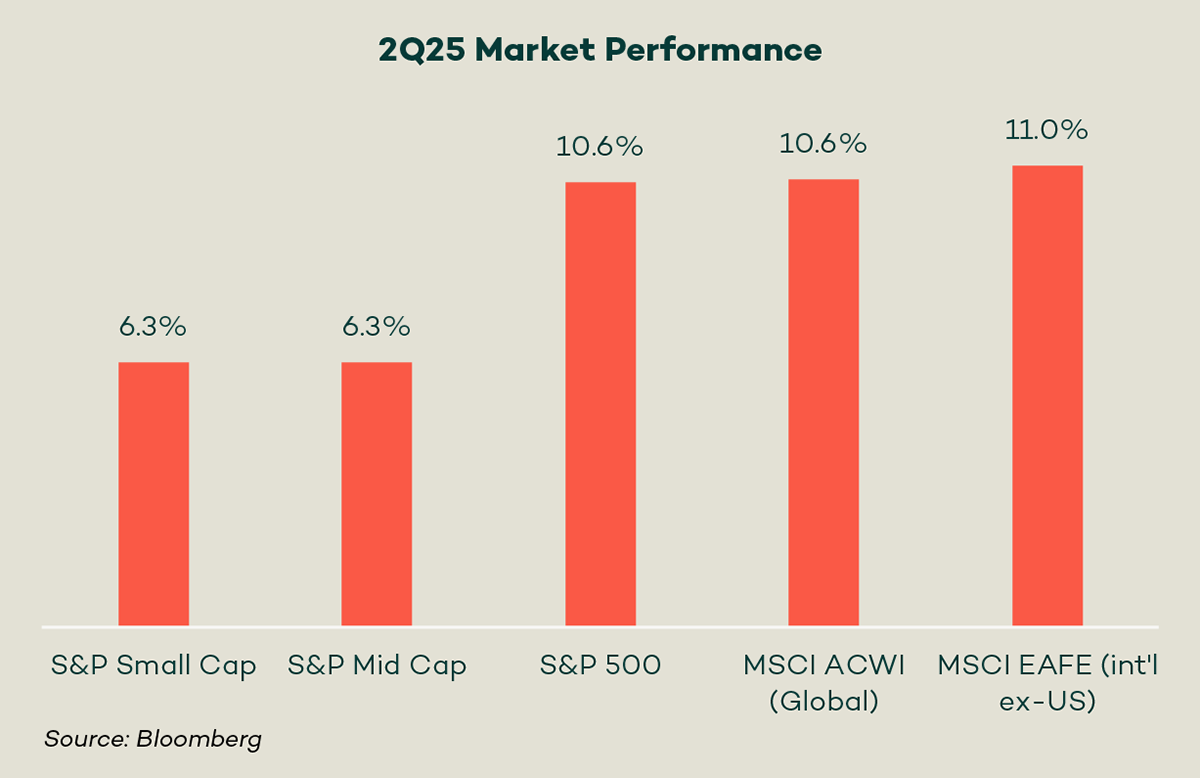

Meantime, the Federal Reserve stood steady on interest rates, with Chair Jay Powell oft-repeating the Fed’s new mantra: “wait and see.” But markets didn’t wait. They moved. Over 62 volatile sessions, markets slid dramatically and then recovered almost as quickly, driving the S&P 500 on a full round trip within weeks. When all was said and done, global stocks - as measured by the MSCI ACWI index - delivered a very healthy 2nd Quarter of 2025, up 10.6%.*

International equities (EAFE) continued their relative strength, gaining 11%. Bonds, too, ended in positive territory (Barclays Agg +1.4%) as policy jitters

modestly faded. Washington, for all its wild gyrations, hasn’t (yet) derailed the underlying economic engine.

Capital tends to seek coherence, and lately, it’s been finding more of it outside U.S. borders. Europe, for all its economic sluggishness, is finding fiscal footing and moving in rare economic unison. With valuations that are significantly more attractive than those for big US stocks, we see opportunity in European and other international markets.

We’re aligning our portfolios accordingly.

Climate Progress Persists

The Trump administration has ushered in a very tough period for clean energy policy in the U.S. The federal government’s decimation of Inflation Reduction Act provisions will certainly lead to delays or funding claw backs for important climate-related projects – especially those in economically disadvantaged areas.

That said, we fully expect the clean energy transition to continue – although at a frustratingly slower and bumpier pace than the planet is mandating. A May report from the Clean Investment Monitor offered an encouraging snapshot of current energy spending for 2025 to date, while IRA tax credits are still in place. In 1Q25, solar, wind, battery, and related investments reached ~5% of total U.S. private investment, a record high. Since the IRA passed in 2022, $321 billion has been invested across clean infrastructure, with another $522 billion committed**. The project pipeline through Q1 2025 remains strong, including $41.3 billion in new utility-scale clean power announcements.

Some industry veterans are finding reasons for optimism in today’s environment. For example, Vinod Khosla, Sun Microsystems cofounder turned “green investor” argues that the loss of subsidy support could force climate innovation and private investment into overdrive.

From our vantage point, we see corporate climate commitments continuing, with continued investment in decarbonization and clean energy innovation.

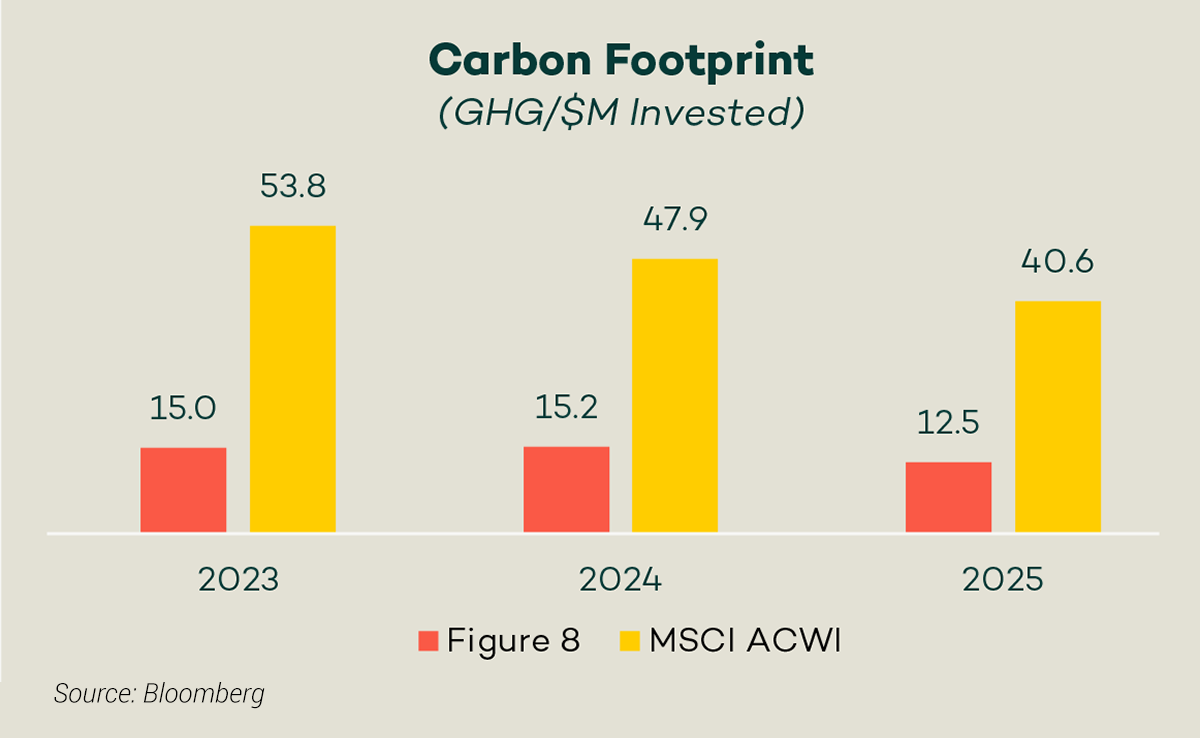

We’re also seeing this commitment reflected across our portfolio holdings - and indeed the universe of stocks as a whole. The chart at left shows how carbon intensity for a broad range of companies (as measured by greenhouse gas emissions per dollar invested – see yellow bars) has shown steady improvement year-over-year, while Figure 8’s portfolio (the red bars) has consistently sat well below the benchmark average.

In addition, ~85% of our portfolio companies – more than twice the global average – have set science-based emissions reduction targets. We’ll be sharing more metrics around our portfolio’s carbon footprint quarters to come. Stay tuned.

Figure 8 Portfolio Activity in 2Q’25

Figure 8 portfolios posted solid gains in Q2, aided by our global flexibility and GARP discipline. Our focus remains consistent: long-term compounding, downside protection, and investing in companies solving climate challenges. That positioning worked, even as Congress tried to rewrite the rules again.

Alternative energy and electrification stocks rallied on a weaker dollar and the survival of core IRA provisions. Nextracker, First Solar, Amalgamated Bank, Trane Technologies, and nVent were all meaningful contributors this quarter. Global exposure also helped: investors sought quality compounders abroad, boosting our holdings in Adyen, HDFC Bank, Aptiv, Netflix, and GSK.

Still, not everything kept pace. After Q1’s AI pause, Q2 reignited momentum—but selectively. Apple and Adobe underperformed as AI leadership narrowed and sales growth slowed. Healthcare stocks generally lagged on policy concerns, with life sciences and surgical exposure proving most vulnerable to looming cuts and clawbacks in federal research budgets, including National Institute of Health grants.

We were active on the trading front. Proceeds from trims of fully valued positions—TSMC, General Mills, and Prologis—were redeployed into several new holdings. We initiated new positions in Intercontinental Exchange and AstraZeneca—both global leaders aligned with long-term sustainability themes. These additions also increased our international exposure, where we continue to see stronger growth and more attractive valuations.

When the volume in the markets hits 11, we return to first principles. This quarter, that meant reevaluating our current holdings and scouring for global opportunities. We found no shortage. Relative to the US market, expected future earnings growth made global markets a fertile ground for idea generation in Latin America, Korea, and Europe. While the market's sharp snapback forced patience on some of the new ideas we underwrote, the direction of travel remains clear.

More to come.

* Market Performance sourced from Bloomberg** Rhodium Group/MIT-CEEPR Clean Investment MonitorYou should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. This material is intended for educational purposes only. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost.