Quarterly Commentary 3Q’25

Ozempbound

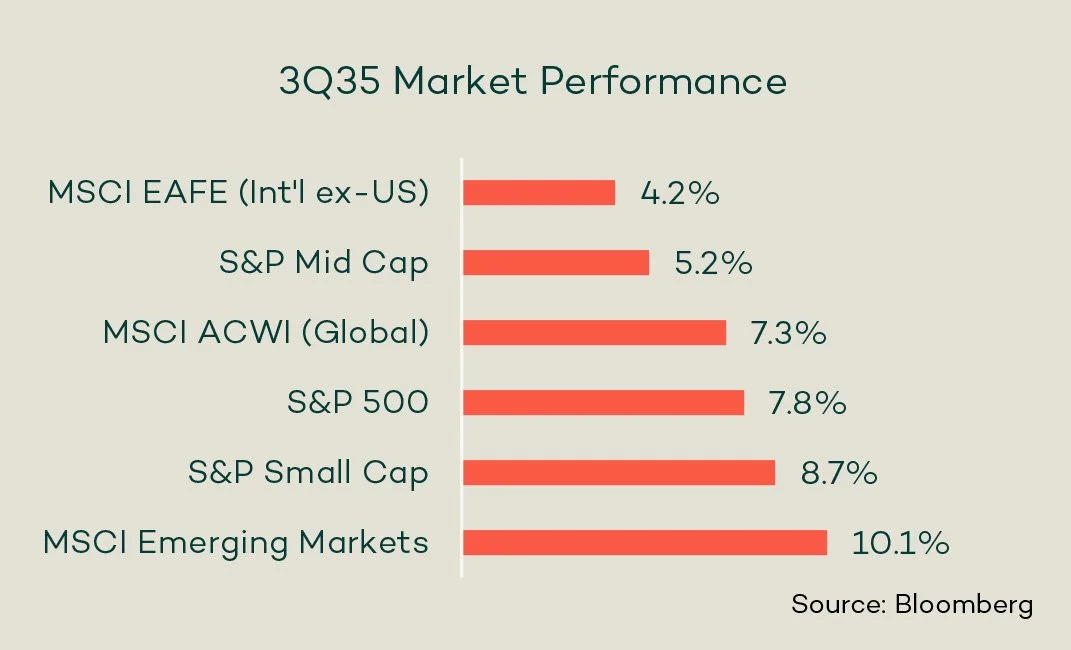

2025 has been a year for antacids. Tariffs, weaker job reports, fractious politics, and an anticipated government shutdown should have left investors doubled over. Instead, they spent the third quarter gorging on risk assets and pushing major indices to record highs*. Emerging markets spiked +10.1%, small caps +8.7%, and U.S. large caps +7.8%—driven by resilient earnings, a moderating rate environment, and the ongoing AI frenzy.

Developed international markets gained +4.2%, trailing U.S. peers as Europe wrestled with renewed political discord. Bond investors, usually a sane bunch, joined the feast: the Barclays Aggregate Bond Index rose +2.4% as the Federal Reserve resumed its cutting cycle, lowering rates by 0.25% in September.

Entering 4Q, the menu looks less appetizing. The labor market is flashing yellow.

September’s BLS** revision erased nearly a million jobs from the first quarter, and momentum has continued to fade—payroll growth averaged just 30,000 over the past three months, with August adding 22,000. That’s well below the pace typically needed to sustain a stable labor market, according to the BLS and St. Louis Fed. Unemployment stands at 4.3%, but conditions are uneven: new graduates face a tougher market, and progress narrowing the racial wealth gap has stalled as Black unemployment ticked up to 7.5%***.

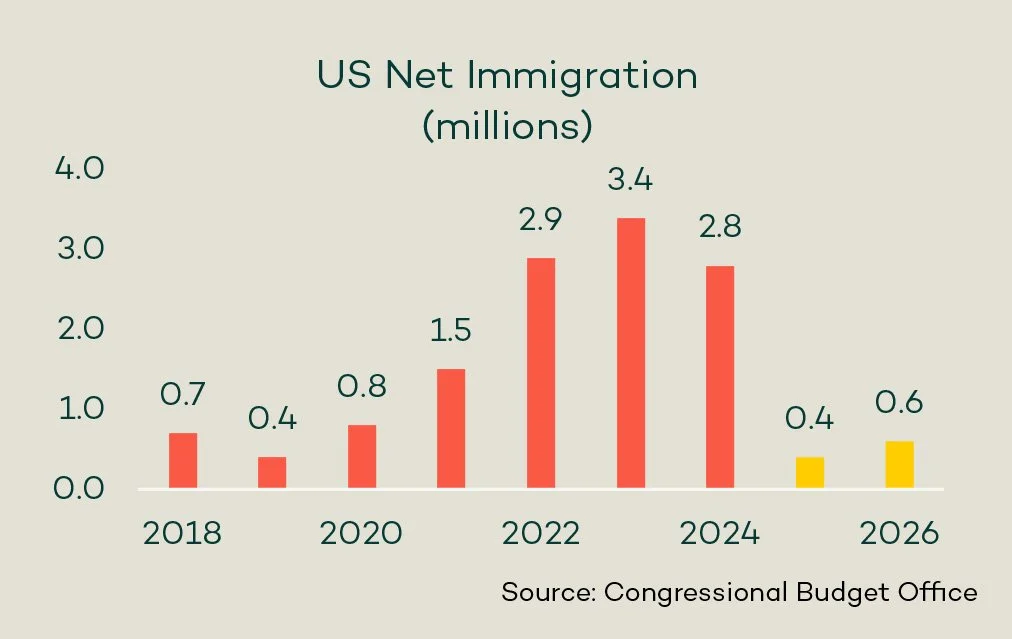

Immigration—one of the key growth drivers of recent years—has also reversed. Net inflows into the US averaged +2.6 million annually from 2021 to 2024 (see chart left), supplying both labor and demand. In 2025, inflows are expected to collapse. The CBO projects**** (see yellow bars in chart) just +0.6 million in 2026, which could weigh on employment growth in sectors such as construction, food services, and manufacturing.

The data points to a cooling economy. Our base case anticipates a slowdown through year-end, but not a recession. The market spent 3Q binging on risk assets. Now comes the Ozempic. In our view, investors are likely to learn some portion control as volatility returns to the highly valued, most extended names. Beyond this near-term adjustment, we see GDP growth normalizing around 2% in 2026, supported by fiscal stimulus, tax cuts, consumer spending, and a more accommodative Fed. When volatility creates entry points, we’ll use them to our advantage, adding high-quality, sustainable names at better prices.

Bulking Up for Winter

The stock portfolios we manage for clients largely kept pace with major benchmarks during the quarter. A corporate capital spending boom drove gains, with contributions from Corning, Taiwan Semiconductor, Nvent Electric, and ASML Holding. Stocks like D.R. Horton and Aptiv PLC benefited from lower rates and improving growth sentiment. With Inflation Reduction Act policies clarified—but not rescinded—in the new budget bill signed in July, First Solar and Nextracker posted double-digit gains.

Headwinds came from financials: Adyen, HDFC Bank, and Amalgamated fell on rate sensitivity. Defensive holdings like Costco and Kerry Group lagged in the risk-on rally.

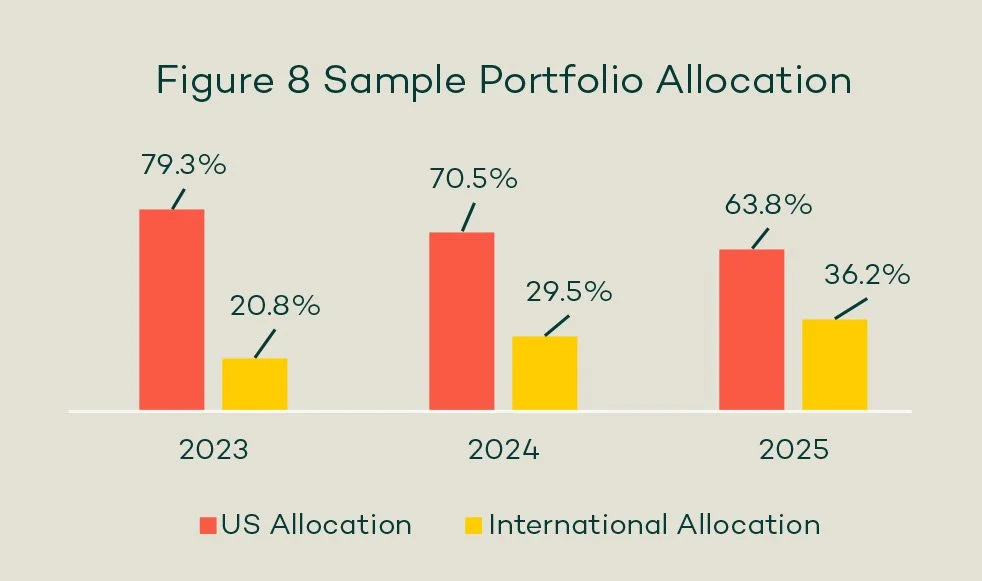

Across portfolios, we’ve been working to broaden holdings and geographic exposures*****. Tactically, international markets continue to offer relative valuation opportunities, while structurally, we’re finding compelling compounders in secular themes such as robotics, e-commerce & payments, and sustainable risk management. In the 3rd Quarter, new purchases included:

MercadoLibre (MELI): Latin America’s dominant e-commerce and FinTech platform, which we see as offering strong growth paired with tangible impact—digital access, credit provision, EV deliveries, and renewable-energy transition; we like it for inclusion and decarbonization at scale.

Willis Towers Watson (WTW): Global leader in climate-risk advisory; as disclosure standards tighten and insurance reprices climate exposure, we see WTW’s analytics and net-zero positioning the company to deliver steady, high-margin growth.

Fanuc (FANUY): Japan’s factory-automation giant, providing energy-efficient robotics that reduce power use, minimize waste, and enable EV and solar production—a quiet backbone of the low-carbon industrial transition.

We funded these purchases by selling full positions in General Mills and Henry Schein on concerns about weakening sales trends, and by trimming outsized positions in Sony, Flex, and NXPI Semiconductors that have enjoyed recent strong runs.

Seeding Change

A critical component of our impact work is shareholder stewardship—engaging portfolio companies to improve corporate processes and build stakeholder value. Each year, engaged shareholders file proposals with companies asking them to address corporate practices around key environmental, social, and governance issues. Many of these proposals go to a vote during the spring “proxy season” when most corporate annual meetings are held. Ideally, the shareholder proposal process leads to changes that align the long-term best interests of society, the planet, and shareholders.

Some of the most meaningful progress happens behind the scenes, when productive engagements between shareholders and corporate executives result in agreements for action and withdrawal of the resolution. In challenging times, this dialogue matters more than ever. It deepens our understanding of how companies assess and mitigate sustainability risks while investing in sustainable innovation.

In recent months, Figure 8 co-filed two shareholder proposals: one with Microsoft over AI and cloud services used in the Israel-Palestine conflict, and one with Costco on avocado sourcing from illegally deforested lands. We’ve seen progress on both fronts.

Costco committed to working with suppliers to prevent sourcing from deforested lands.****** In 2026, the company will meet with our partners at As You Sow to discuss supply-chain mapping of at-risk commodities and enhance forest-stewardship disclosure.

Microsoft’s case illustrates the complexity of responsible tech deployment. The company has historically followed the UN Guiding Principles on Business and Human Rights, but hasn’t published clear reports on its due-diligence process—leaving investors uncertain about how it ensures customers don’t misuse AI and cloud services. In response to an August report in The Guardian******* that the Israeli Defense Forces’ Unit 8200 used Microsoft systems to track Palestinian phone calls, the company stopped providing certain services to a division of the Israeli Ministry of Defense. The decision followed both investor pressure and employee protests over Israel’s use of Microsoft software in Gaza.

These engagements show that impact investing extends well beyond portfolio construction. When companies face sustained, transparent stakeholder pressure—from investors, employees, or the public—they respond. Our role is to apply that pressure with clarity and persistence. Progress isn’t always headline-worthy, but it compounds over time.

* Performance sourced from Bloomberg

** Bureau of Labor Statistics: The Employment Situation 9/5/25

*** The New York Times: “Black Unemployment Is Surging Again. This Time Is Different” 10/12/25

**** US net immigration data, projections, and chart sourced from Congressional Budget Office and Evercore ISI

***** Figure 8 Sample Portfolio Allocation from Bloomberg (2025 data as of 9/30/25; 2024 & 2023 as of FY end)

****** As You Sow – Resolution Details 10/20/25

******* The Guardian: “Microsoft blocks Israel’s use of its technology in mass surveillance of Palestinians” 9/25/25You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. This material is intended for educational purposes only. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost.